Amazon CTV Explained: Strategy, Targeting, and Real Results

| Pathlabs Marketing |

| September 30, 2025 |

CONTENTS

Every independent agency leader has asked this at some point: Is Amazon CTV truly different from the other CTV platforms, or just another inventory source in a crowded market? After all, with more dollars shifting into streaming and cord-cutting accelerating, choosing the right platform matters more than ever if agencies want to compete and grow.

This article explores what sets Amazon CTV apart, how its DSP (demand-side platform) works, and why agencies looking to drive measurable growth should take notice.

What Is Amazon CTV Advertising?

Before diving into Amazon's specific offerings, it's important to understand the landscape. Connected TV (CTV) refers to television content accessed through internet-connected devices rather than traditional cable or broadcast. Over-the-top (OTT) describes the delivery method, or content that comes "over the top" of traditional TV infrastructure. Streaming TV encompasses both live and on-demand content delivered via these connected platforms.

Amazon CTV advertising operates within this ecosystem, allowing brands to reach audiences watching content on Prime Video, Fire TV, Twitch, and other Amazon-owned streaming platforms.

How Amazon CTV Works and Where Ads Appear

Amazon CTV campaigns run through Amazon DSP, the company's programmatic advertising platform. Ads appear across Amazon's streaming inventory, including Prime Video's ad-supported tier, Freevee (Amazon's free streaming service), Twitch gaming content, and third-party apps available through Fire TV devices.

Why Amazon CTV Is Worth Agency Investment

When you think of connected TV advertising, you probably picture a fragmented landscape of platforms, devices, and content providers, making shifting advertising budget from linear TV to CTV a daunting task. Amazon CTV brings that chaos into focus for independent agencies through four key strengths.

Premium Inventory and Engaged Viewers

Prime Video reports an average monthly ad-supported reach of 200 million global customers, including 115 million in the U.S., positioning it among the largest premium ad-supported streaming environments available to advertisers. Ad-supported content is available across live sports, original programming, and licensed movies. Freevee adds another layer of free, ad-supported streaming, expanding reach and engagement without sacrificing quality.

Data-Driven Targeting at Scale

Amazon’s first-party commerce data is its strategic advantage. Amazon’s shopping behavior data (what people have purchased, browsed, and categories of interest) is native to the platform. This means that targeting can be done based on purchase intent and actual transaction history, rather than inferred or third-party lookups.

This level of targeting is unique among CTV providers, allowing campaigns to drive measurable outcomes beyond awareness.

Brand-Safe Environment

Because Amazon owns and operates the platforms, advertisers can be confident that their campaigns run in curated, brand-safe environments with controlled ad frequency, which currently sits around four to six minutes per hour.

Growth Trajectory

Amazon’s advertising revenue reached nearly $15.7 billion in Q2 2025, up 23% year over year, driven in part by Prime Video’s expansion of ad-supported tiers.

This momentum is more than a financial headline. It’s a sign that advertisers are finding measurable value in Amazon’s ecosystem. In September 2025, Amazon and Netflix announced a groundbreaking partnership that will allow advertisers to buy Netflix's premium ad inventory directly through Amazon DSP, beginning in Q4 2025 across the U.S., U.K., and nine other markets.

Through Prime Video, Twitch, and Fire TV, agencies can connect campaigns to real purchase data and capture audiences already primed to act. That combination of scale and precision is why Amazon CTV is projected to become one of the fastest-growing players in the U.S. CTV market.

For agencies looking to balance scale with performance, Amazon connected TV platform offers both a curated, brand-safe environment and a data-rich platform designed to prove return on spend.

How Amazon CTV Compares To Other Platforms

Amazon CTV advertising’s value is clear, but the next question is how it compares to other major players, such as Hulu, Roku, or YouTube. This is where Amazon’s strengths become more apparent.

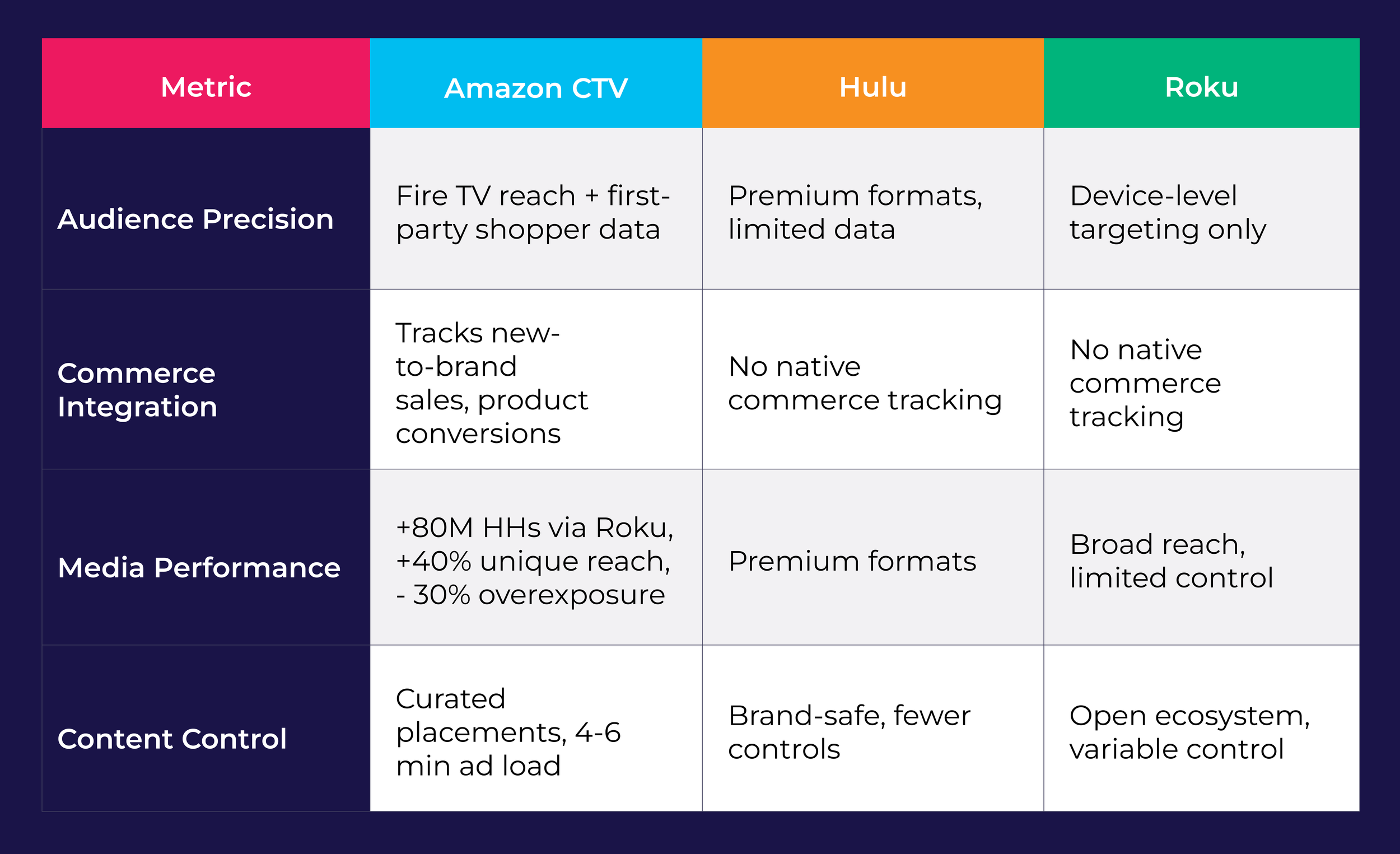

Audience Precision – Roku remains the largest CTV device platform with 37% share, but its targeting relies primarily on device-level data. Hulu offers premium formats like binge ads and pause ads, but has limited commerce data. Amazon combines Fire TV reach with first-party shopper data, enabling deterministic targeting at the household and individual level.

Commerce Integration – Amazon uniquely connects streaming ads with purchase data. Advertisers can measure new-to-brand sales and product-level conversions, a capability that Hulu and Roku cannot match natively.

Media Performance – In June 2025, Amazon Ads and Roku announced an exclusive integration that gives advertisers access to an estimated 80 million U.S. CTV households through Amazon DSP. Early tests cited by the companies showed 40% more unique viewers on the same budget and nearly 30% lower ad overexposure, signaling efficiency gains from authenticated reach and shared identity.

Content Control – One of Amazon CTV’s largest advantages is the control it offers over where ads appear and how often audiences see them. Because Amazon operates a closed, authenticated ecosystem across Prime Video, Fire TV, and Twitch, advertisers benefit from brand-safe placements, consistent ad quality, and reliable frequency management at the household level.

The result is a platform designed not only for reach but also for measurable performance outcomes, something clients increasingly expect from their media partners.

How Programmatic Buying Works On Amazon

For agencies ready to execute, the Amazon DSP serves as the campaign engine. It’s where agencies can tap into Amazon’s massive first-party data set, select premium inventory, and set the parameters that govern when and how ads are served.

The DSP’s advantage lies in unifying audience building, cross-channel execution, and real-time reporting. Agencies can pull segments built on shopping behavior, pair them with curated streaming inventory, and manage frequency across CTV, display, and video from one platform. This single point of control ensures campaigns run efficiently and stay aligned with client objectives. Lastly, the Amazon DSP is the only doorway to Amazon Prime’s premium video content, adding to its unique value among DSPs.

Once the campaign framework is in place, the next step is understanding how the DSP actually delivers those ads and how agencies can influence performance as campaigns run.

How Ads Are Bought, Delivered, and Optimized

The buying workflow on Amazon DSP follows a deliberate, step-by-step process that makes CTV activation highly structured. Agencies first define who they want to reach, using signals like demographics, purchase behavior, or remarketing pools. From there, they choose where those ads will appear, whether that’s Prime Video’s ad-supported tier, Freevee, Twitch, or Fire TV apps.

Creative assets are then uploaded and reviewed to meet Amazon’s specs, ensuring that every impression maintains broadcast-level quality. Once live, campaigns are fueled by real-time bidding and predictive algorithms that constantly evaluate inventory, cost, and expected engagement.

Optimization is not a one-and-done exercise. Budgets can be reallocated on the fly, low-performing segments can be paused, and high-performing audience groups can be expanded. This continuous feedback loop enables CTV to function as both a branding and performance channel.

With campaigns running and budgets actively managed, measurement becomes the next critical step, and agencies need to know whether their investment is resonating with audiences and driving incremental results.

Understanding CPCV, VCR, and New-to-Brand Metrics

Amazon DSP provides agencies with a comprehensive set of metrics designed to show both efficiency and impact. Cost per Completed View (CPCV) reveals how much it costs to get viewers to finish, a key metric to keep spend accountable. Video Completion Rate (VCR) highlights whether creative and targeting are compelling enough to hold attention.

Perhaps most importantly, new-to-brand metrics go beyond vanity measures to show how many of those impressions resulted in first-time purchasers. For agencies, this is a powerful way to prove incremental growth and justify continued CTV investment to clients.

When taken together, these metrics allow agencies to not only validate that campaigns are running efficiently but also to demonstrate that they are moving the needle on acquisition, not just awareness.

Tracking Success Across Channels

Running a great CTV campaign is only half the job. The real value for agencies comes when you can connect CTV results to the rest of the media mix and show clients the bigger picture. Amazon DSP makes that connection possible by feeding campaign data into cross-channel reporting systems and analytics tools like Amazon Marketing Cloud (AMC).

How Amazon CTV Data Integrates with Cross-Channel Reporting

Amazon DSP reporting can export performance data into existing analytics stacks, allowing agencies to view CTV results alongside search, display, and paid social campaigns. This integration gives teams a single source of truth for impressions, spend, and conversions, eliminating guesswork and siloed reporting.

With this level of visibility, agencies can uncover patterns like which CTV audiences drove the most incremental conversions on Amazon or how exposure on Prime Video correlates with increased branded search volume. The result is a clearer understanding of where CTV fits in the customer journey and how it contributes to client KPIs.

Aligning CTV Performance with Broader Campaign Goals

The next step is aligning those insights with strategic objectives. Agencies can use Amazon DSP data to see whether CTV campaigns are effectively building awareness, generating new-to-brand buyers, or retargeting high-value audiences more efficiently than other channels.

This alignment helps agencies make smarter budget decisions, shifting spend to the CTV placements that complement their search and social efforts. It also strengthens client reporting by connecting ad exposure to outcomes that matter, such as market share growth, customer acquisition, and lifetime value.

Amazon CTV reporting closes the loop between streaming exposure and business results. By integrating DSP data with cross-channel dashboards, agencies can view impressions, completions, and conversions alongside other digital channels, then tie those outcomes back to client objectives. This holistic view transforms CTV from an isolated tactic into a measurable, strategic driver of awareness, consideration, and conversion.

Overcoming Common Execution Challenges

Amazon CTV is powerful, but running it effectively requires more than turning on a campaign. Many independent agencies face three recurring challenges when scaling CTV efforts, and addressing them head-on can be the difference between an efficient, ROI-positive channel and one that drains time and resources.

Navigating Setup Complexity and Creative Requirements

Amazon DSP offers precise targeting options, but that precision comes with detailed setup work. Creative specs must meet platform requirements for length, resolution, and audio. Audience building requires careful selection of demographic, behavioral, and purchase-based segments. Pacing and frequency controls need to be configured before launch.

Without a repeatable process, these steps can slow activation and frustrate teams that are already managing multiple campaigns across channels. Streamlining the workflow—through templates, pre-approved creative formats, and clear audience frameworks—helps agencies launch faster and maintain quality across clients.

Solving Attribution and Measurement Gaps

CTV measurement and attribution across a multi-device household remains complex throughout the CTV market. Amazon’s new-to-brand metric, household-level reach, and authenticated identity across Roku and Fire TV via the 2025 partnership offer stronger signals for incremental lift and frequency management, which can reduce waste and improve reporting quality.

Scaling Campaigns Without Expanding Internal Teams

Perhaps the most common challenge for independent agencies is bandwidth. Running programmatic campaigns at scale demands dedicated buyers, analysts, and optimization specialists, roles that many agencies are not staffed to support. The risk is either burning out internal teams or leaving growth opportunities untapped.

The solution is to add execution capacity without adding headcount, which is where a trusted media execution partner can make a measurable difference.

How Pathlabs Simplifies Amazon CTV For Agencies

Pathlabs serves as a Media Execution Partner for agencies that want to execute Amazon CTV campaigns without the operational headaches.

Pathlabs manages every step of the process inside Amazon DSP, from audience strategy and creative setup to pacing, optimization, and QA. This ensures campaigns launch on schedule, meet Amazon’s quality standards, and are continuously monitored for performance.

Agencies get a single point of contact who understands both the technical requirements of Amazon DSP and the business goals of the agency’s clients. That combination reduces friction and gives teams confidence that campaigns are running as planned.

Is Amazon CTV Truly Different From The Other CTV Platforms?

Amazon CTV is more than just another streaming inventory source. It is a performance-focused, data-driven advertising solution that combines premium content, first-party audience insights, and measurable outcomes at scale.

For independent agencies looking to deliver client growth, Amazon CTV offers a powerful way to reach audiences and prove ROI with clarity.

The key differentiators, such as targeting through shopping behavior, authenticated household-level reach, and native commerce integration, make Amazon CTV a compelling choice for agencies seeking to demonstrate tangible business impact from their streaming investments.